Professional Tax is a tax levied on professions and trades in India. It is a state-level tax and has to be compulsorily paid by every member of staff employed in private companies. The owner of a business is responsible to deduct professional tax from the salaries of his employees. He can then pay the amount so collected to the appropriate government department. In this article, we look at Professional Tax in Tamil Nadu with emphasis on the process for registration, professional tax rates, and professional tax return filing.

Tamil Nadu Professional Tax Registration

Professional tax in Tamil Nadu is applicable to every company which transacts business and for persons engaged in any profession, trade, calling, or employment. The professional tax is calculated by self-assessment and is based on the half-yearly gross income of the employee or professional.

Who Is Responsible for Collecting and Paying Professional Tax in Tamil Nadu?

The Commercial Tax Department of Tamil Nadu is responsible for collecting professional taxes within the State.

According to the Tamil Nadu Municipal Laws Second Amendment Act 59 of 1998, Section 138 C, individuals involved in any profession, trade, employment, or calling within the city boundaries of Greater Chennai must pay half-yearly professional tax. To be precise, this tax is applicable for

- Salaried Individual: Employers deduct P tax in Tamil Nadu from the salaries of all employees and submit it to the State Government.

- Self-employed Individuals: Self-employed individuals are liable to submit P tax in Tamil Nadu on their own.

Additionally, the professional tax is applicable for companies’ private establishments. Further, the list includes Hindu Undivided Family (HUF), firm, company, corporation or other corporate body, any society, club, a body of persons or association.

Revised Professional Tax in Tamil Nadu

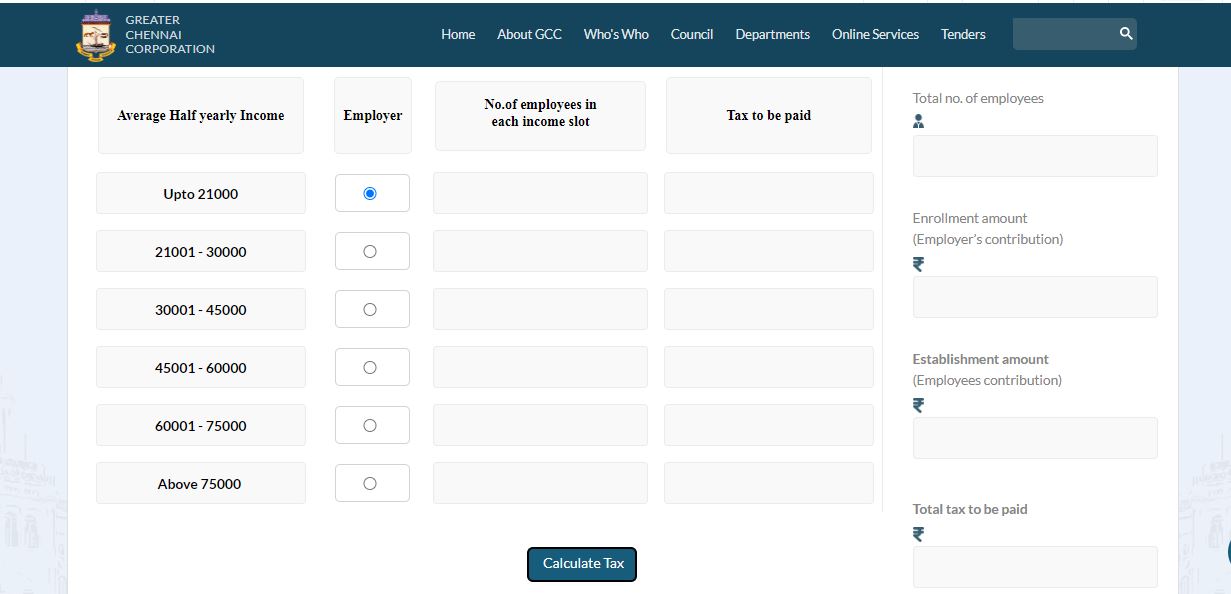

The slab of the profession tax has been revised for Tamil Nadu in the year 2018. The following are the slabs of Professional Tax in Tamil Nadu:

| Sl. No. | Six months’ income (Rs.) | Old Tax (Rs) | New Tax (Rs) |

| 1 | Up to 21,000 | – | – |

| 2 | 21,001 – 30,000 | 100 | 135 |

| 3 | 30,001 – 45,000 | 235 | 315 |

| 4 | 45,001 – 60,000 | 510 | 690 |

| 5 | 60,001 – 75,000 | 760 | 1025 |

| 6 | 75,001 and above | 1095 | 1250 |

Date for Professional Tax Payment in Tamil Nadu?

The payment due date of professional tax is 1st April and 1st October for the respective half-year.

In case employers/individuals delay paying P tax payments, they have to pay a penalty of 2% per month. Non-payment of P tax will attract an additional penalty of 10%. If employers or individuals provide false or incorrect information, they will be accountable for paying a penalty of 3 times of total due tax amount.

Documents Required for Professional Tax Registration in TN:

The following is the list of documentation required for the registration process under the professional tax rules of Tamil Nadu:

- Shops and Establishment Trade License Copy/Registration Certificate

- Lease Agreement

- PAN Card

- Articles of Association

- Memorandum of Association & Incorporation Certificate

These requirements are subject to periodic change as per directions provided by the Tamil Nadu state government.

Tamil Nadu Profession Tax Payment Procedure

Property tax should be paid within 15 days from the commencement of the half-year i.e. the month of September and March. Payment can be made to all zonal offices of the respective municipal authority within the state of Tamil Nadu by cheque or demand draft.

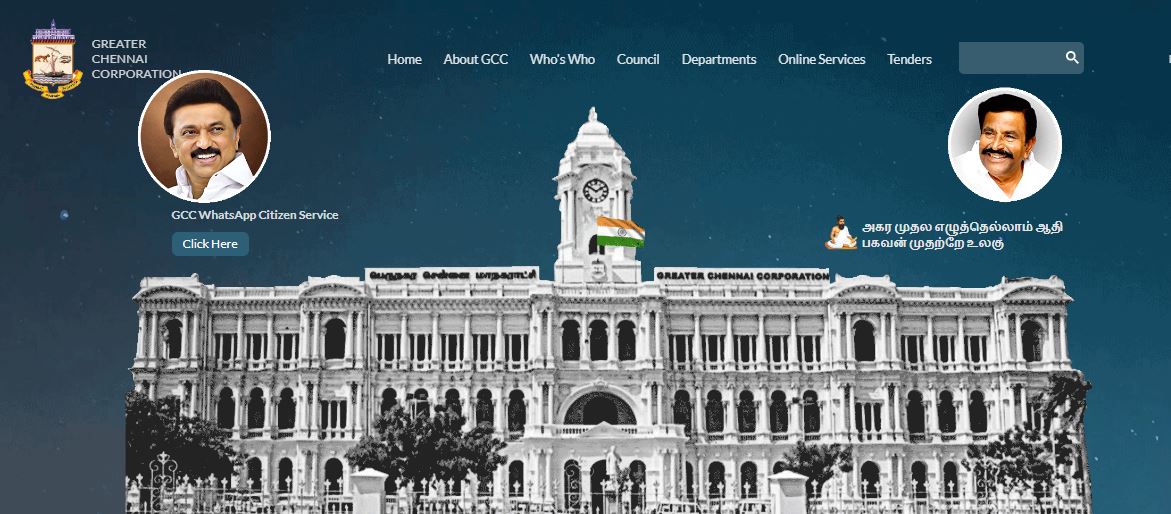

- Log on to the Greater Chennai Corporation website and click on the ‘Online services’ option shown in the menu bar.

|

- Now, select and click on the ‘Profession Tax’ tab shown among the various options. The link will redirect to the new page.

- Log on to the new page using the user name and password. If you are not a registered user, please register yourself first by clicking on the ‘Not Registered’ option.

- Now you can know the profession tax due amount using the profession tax calculator available in the Greater Chennai Corporation.

- Online payment of professional tax in Tamil Nadu can be completed using your credit card, debit card, or net banking of major banks in India.

Exemption From Paying Professional Tax in Tamil Nadu

Following is a list of individuals, who can enjoy exemption from professional tax in Tamil Nadu,

- Individuals above the age of 65 years

- Women agents who are working exclusively under the Mahila Pradhan Kshetriya Bachat Yojana or the Director of Small Savings.

- Guardians or parents of children with mental disability

- People with a permanent physical disability, including blindness

- Badli workers of the Textile industry

- Military personnel of the forces as per the Navy Act 1957, the Army Act 1950, and the Air Force Act 1950, along with reservists working for the State or members of the auxiliary forces.